Explore our blog featuring articles about farming and irrigation tips and tricks!

Pricing Land That’s Not for Sale

By: Mark McLaughlin

q

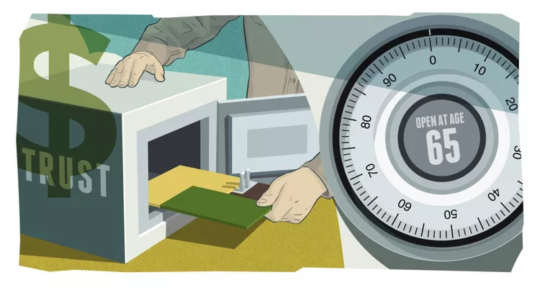

When my parents died, they put their land in a trust until I’m age 65. They wanted to prevent my siblings from selling the land until I reached a “good retirement age.” They meant well, but it’s always a battle to negotiate rent with my brother, and my sister’s upset because she just wants cash. Age 65 is two short years away and I have no plans of retiring. I just wish I could’ve collateralized the trust assets for my expansion along the way. That said, the trust has kept the land intact so far. Now I’m starting to think about our children and the land my wife and I own. One of our four kids farms with us. He’ll never be able to buy out his siblings at these prices. I understand now why my folks did what they did. I was raised to believe family ground should never be sold. So, should we lock our land up in a trust too?

a

Your parents did the best they could with the options they were given. However, it sounds like the trust that prohibited a sale still cost something. It has cost you strained relationships, limited expansion, and potential disruption when the trust expires. Your siblings pay the opportunity cost of not receiving a lump sum of cash to apply toward their goals, and their inheritance depends on your farming performance.

Stay up to date on all T-L news and get alerts on special pricing!